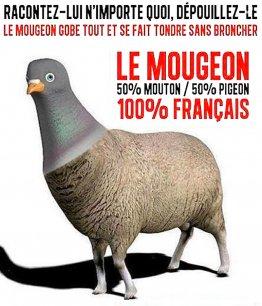

Start-up: "Pigeons" and "Anti-Pigeons" fly in feathers on the net

Depuis vendredi soir, de drôles d'images de pigeons ont remplacé les profils d'entrepreneurs ou de sympathisants entrepeneurs plus ou moins célèbres sur Twitter ou Facebook Tous soutiennent «Les Pigeons - mouvement de défense des entrepreneurs français»», un groupe créé sur Facebook, qui n'hésite pas à citer Corneille.“We left five hundred;But by a prompt reinforcement.We saw ourselves three thousand when we arrived at the port ”, chants the movement on the presentation page.

In fact, the group was created on the night of Friday to Saturday by four web entrepreneurs, who for once are neither Marc Simoncini, nor Jacques Antoine Grangeon (private sale).The four Community Managers of the movement, initiated following the publication on our site of the tribune of Jean-David Chamboredon entitled "An anti-Start-up finance law", are Jeremy Benmoussa de Up2social, Fabien Cohen de Whoozer, Tatiana Jama Gomplewiczof Social Living and Ruben Nataf of 10 Days in Paris.In a few days, @Defensepige attracted more than 3.200 subscribers.7.526 Internet users clicked on the like button on Facebook.A demonstration is even scheduled for Sunday at 3 p.m. before the National Assembly.Never seen!

At the origin of this revolt movement, the 2013 finance law, which aligns the tax regime for capital income on that of labor.From now on, entrepreneurs who will give up their titles will be taxed on the same scale as labor income, up to 60% if we combine the marginal income tax rate and the 15.5% of CSD/CRDS.In his advocacy, Jean-David Chamboredon, ankle worker of Isai, an investment fund of which Pierre Kosciusko-Morizet is part, who ceded Price Minister in Rakuten, denounced the "anti-capitalist dogma, the anti anti anti-Conomic, the "dream breakage", the quasi-sadical demotivation, the "je-ne-sais-quoi-qui-donne-la nausea"...

On Twitter, this cry of resistance received hundreds of supporters, which Marc Simoncini, boss of the Jaina Capital fund did not fail or Marc ("since selling his box is equivalent to salary, the entrepreneurs will go to 35 hours and touch unemployment", said the creator of Meetic), nor the very liberal Pierre Chappaz (ex-Kelkoo), who left long before the left arrives in power, find refuge to more lenient tax heavens.

"He pleads for his parish"

Faced with this movement, other voices are trying to be heard, bringing a downside to these catastrophist predictions. Dans une tribune parue sur Rue89, Romain Blachier a d'abord pointé le fait que Jean-David Chamboredon «plaide pour sa paroisse puisqu'il dirige un fonds d'investissement»».Then he recalled that a start-up in 10 only survives, and that the measure only affects the entrepreneur at the time of the transfer and therefore "in no way the ability to undertake it.It is also in one of the US states where start -ups have a less advantageous tax regime that Silicon Valley was created.What is more taxed is quickly reselling your business, making heritage with it, not creating it, not making it work, not making it grow.»»

"The business manager is presented as a monster eager for money"»

Problem of the Pigeons Movement, "he presents the business manager as a monster eager for money and anti-solidarity.It's detestable.It bristled to me, because money is not our first motivation.First motivation is the new product, adventure and freedom.There are people who think of making their business grow 10, 20 or 30 years.In reality, this movement corresponds to the motivation of investment funds and not entrepreneurs.It should be called "Investment Fund Defense Movement". Mais c'est un autre sujet - intéresant- qui a trait à la compétititivé fiscale»», indique de son côté Jean-Paul Smets, qui a créé il y a une dizaine d'années un éditeur de logiciels libres, Nexedi, et qui se réjouit, lui des dispositions du PFL 2013.In fact, in the PLF, a proportional reduction on the tax calculated on the duration of detention of securities - 40% for the 12th year was also planned.

Maintaining JEI and CIR

"I said to myself, great, they maintained the status of JEI, a real tax haven, and improved the research tax credit (my accountant told me that we would touch more aid next year. Des aides pour monter des projets il y en a des quantités phénoménales»», se félicite l'entrepreneur, qui rappelle que l'on peut monter une entreprise sans lever de fonds auprès de capital risqueurs, et qui tente de monter un groupe concurrent aux Pigeons.

The thing to circumvent taxation on capital gains

D'autant que les entrepreneurs qui désirent réinvestir «une part de leur gains»» ne seront pas soumis aux nouveaux régimes.Remember that so far, entrepreneurs already avoided paying the most values -without having to leave the territory.How?They just had to create an ad hoc society in which they were staying their titles.Then, it was this company that gave up the actions, pocketed the profits by avoiding corporate tax (copé niche) and paid for remuneration in the form of dividend.Obviously, insofar as both the copé niche but also the diet on dividends will be weighed down, the trick will be less interesting tomorrow.

5 minutes

To share :